Herbert Allen III Net Worth: A Behind-the-Scenes Look at a Financial Powerhouse

Determining the precise net worth of Herbert Allen III, the enigmatic figure behind Allen & Company, is a challenge. Allen & Company's operations are famously discreet, making a definitive figure elusive. Yet, the firm's influence is undeniable, extending far beyond Wall Street’s glitziest headlines. Their success stems not from ostentatious deals, but from a shrewd blend of high-stakes tech investments and surprisingly steady, long-term bets, including a significant, though undisclosed, stake in Coca-Cola. For comparison, see Bill Gurley's net worth here. This article delves into the strategies, risks, and enduring legacy of Allen & Company, offering a glimpse into the methods of a master investor.

How much is Herbert Allen III actually worth? It's a question that tantalizes financial analysts and fascinates the public, a testament to the effective opaqueness of his firm's operations. But the true value lies not just in the numbers, but in understanding how Allen & Company's success has been built, its lasting mark on the tech landscape, and its surprisingly enduring relationship with a legacy brand like Coca-Cola.

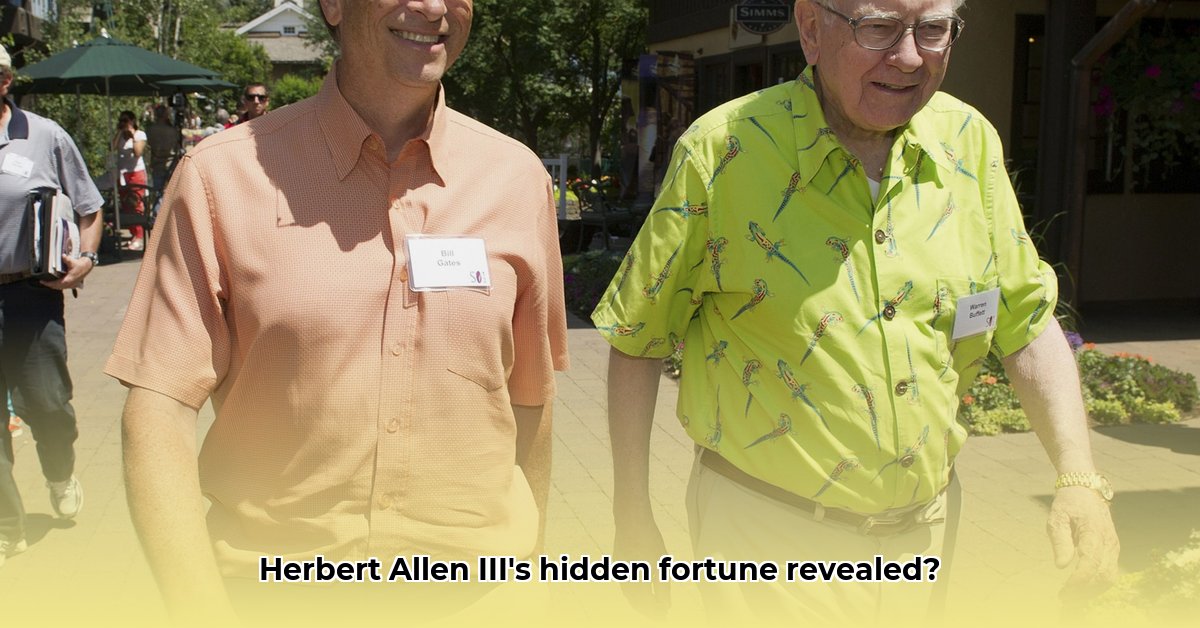

The Sun Valley Summit: Where Deals Are Made and Fortunes Forged

Allen & Co.'s annual Sun Valley Conference isn't just a meeting; it's a high-powered networking event. CEOs, tech giants, and media moguls convene in an informal setting, forging connections that often translate into multi-million-dollar deals. This exclusive gathering fuels innovation and investment, creating a significant, though unquantifiable, impact on Herbert Allen III's wealth. But how directly does this translate into his personal fortune? The answer is complex and requires a deeper understanding of the firm’s operations.

Think of it as a private, high-stakes brainstorming session: Ideas are exchanged, partnerships are formed, and the ripple effects are felt across various industries. The Sun Valley Conference serves as a critical catalyst for deal-making, and the connections formed may yield substantial long-term returns for Allen & Company and its principal. The question remains: How much of this translates directly to Herbert Allen III's personal wealth?

Tech IPOs: A Cornerstone of Allen & Co.'s Success

Allen & Co. has played a pivotal role in guiding numerous tech giants through their initial public offerings (IPOs), including Twitter, LinkedIn, and Groupon – companies which fundamentally reshaped communication, networking, and e-commerce. The firm’s expertise in navigating the intricate world of IPOs is a major contributor to their overall success and to Herbert Allen III's wealth. Their involvement wasn't merely advisory; they were key players, guiding these companies towards immense financial success.

This isn't just about market savvy; it's about trust, navigating complex regulations, and managing the volatility of the stock market. This high-stakes expertise has undeniably enhanced the firm's financial performance. How much has this contributed to Allen III's personal net worth, given the complexity and confidentiality of investment banking? It's a question that cannot be answered with hard numbers, but one whose significance is undeniable.

Beyond Tech: A Surprisingly Diverse Portfolio

Allen & Co.'s investments extend far beyond Silicon Valley. Their significant stake in Coca-Cola, for instance, demonstrates strategic diversification, mitigating risk and ensuring long-term growth. This underscores a deep understanding of the financial landscape, extending beyond the high-octane world of tech startups. This less-publicized element adds another dimension to their investment strategy and contributes to the overall wealth generation of the firm.

This diversification strategy suggests a level of long-term vision and risk management that is not always characteristic of firms focusing solely on emerging growth markets. The Coca-Cola investment demonstrates a longer-term strategic view, potentially tempering the naturally higher risk involved in the volatile world of tech IPOs.

The Enigma of Discretion: Why Exact Figures Remain Elusive

Pinpointing Herbert Allen III's net worth is nearly impossible. Allen & Co.’s discreet operations, while frustrating for those seeking concrete numbers, likely contribute to their success. This secrecy allows them to pursue unique opportunities without constant public scrutiny. It's a strategy that differs sharply from the transparency often expected of large investment firms. Is this deliberate secrecy an advantage that ultimately enhances their competitiveness and profitability?

Some might argue this deliberate lack of transparency is a strategic choice, allowing the firm to operate with greater agility and flexibility. Furthermore, this level of privacy could also serve to protect their carefully constructed network of relationships.

Navigating the Future: Challenges and Opportunities for Allen & Co.

The future prosperity of Allen & Co. and Herbert Allen III hinges on their adaptability. Maintaining their edge requires anticipating new trends, nurturing key relationships, and making astute investments. Their continued success will depend on their ability to navigate the ever-changing market.

The financial landscape is dynamic and unpredictable. Allen & Co.'s ability to adapt to the changing technological landscape and ongoing regulatory changes will greatly influence the firm's long-term success. Their ability to anticipate future opportunities and manage risk will ultimately dictate Herbert Allen III’s overall wealth accumulation.

How Allen & Co.'s Investment Strategy Balances Tech IPOs and Coca-Cola

Key Takeaways:

- Allen & Co.'s influence extends beyond deal-making; their network shapes the tech landscape.

- Their involvement in high-profile tech IPOs demonstrates expertise in complex financial maneuvers.

- Limited public information obscures a complete picture of Allen & Co.'s investment approach.

- The Sun Valley Conference acts as an unparalleled networking hub, creating both opportunities and limited transparency.

- The balance between tech IPOs and Coca-Cola underscores the firm's diverse holdings and discreet operations.

The success of Allen & Co. isn't solely attributed to one market; rather, it is built on a foundation of strategic diversification. The firm’s strategy, however, remains subtly opaque with exact specifics left undisclosed, adding another layer of mystery to Allen III's overall net worth.